"Payable When Able" Feature, is the Best Option for Builders

Building homes and real estate projects can be a rewarding endeavor, but it often comes with financial challenges. This is where the Special Window for Completion of Construction of Affordable and Mid-Income Housing Projects (SWAMIH) Fund steps in as a game-changer for builders. In this blog, we’ll explore why the SWAMIH Fund, with its unique “Payable When Able” feature, is the best option for builders.

- Government Backing:

SWAMIH Fund carries the powerful backing of the Indian government. This backing not only infuses confidence but also signifies a commitment to supporting the housing sector. Builders can trust that the fund is well-structured and sustainable.

- Financial Assistance:

Builders often face financial constraints during the construction phase. SWAMIH Fund provides crucial financial support to complete stalled or delayed projects. What makes it even more builder-friendly is the “Payable When Able” feature. This means that builders can repay the funds when their projects start generating revenue, reducing immediate financial burden.

- Focus on Affordable Housing:

SWAMIH Fund primarily targets affordable and mid-income housing projects. This aligns with the government’s vision of ‘Housing for All by 2022.’ For builders, this means a ready market and a higher likelihood of selling units, as demand for affordable housing remains consistently high.

- Timely Completion:

Delayed projects can lead to cost overruns and a loss of trust among buyers. The SWAMIH Fund’s objective is to ensure the timely completion of projects. Builders can rely on this support to meet deadlines and deliver quality housing to buyers.

- Reduced NPA Risk:

Unfinished projects often turn into non-performing assets (NPAs) for builders. The SWAMIH Fund’s intervention helps reduce the NPA risk associated with stalled projects, keeping builders’ financial health intact.

- Boosting Investor Confidence:

With the backing of SWAMIH Fund, builders gain credibility in the eyes of potential investors and buyers. This can attract more investment and customers, further facilitating project completion.

- Expert Management:

SBICAP Ventures, a seasoned participant in the real estate sector, is in charge of managing the fund. Their knowledge guarantees that the financial aid is effectively managed and applied.

- Reviving the Real Estate Sector:

The SWAMIH Fund helps to revive the real estate industry by giving stalled projects a lifeline. Thus, the environment for builders becomes healthier and more energetic.

- Payable When Able:

The SWAMIH Fund’s “Payable When Able” option stands out as a very strong point and is unquestionably helpful to builders. Due to this special feature, developers can pay back the loan after their projects are finished and they begin to make money. Because it lessens the immediate financial burden on builders, this is a game-changer. Builders can concentrate on the project’s successful completion throughout the construction period rather than worrying about loan repayments. It is a very builder-friendly financing solution since if the project is lucrative, they can easily pay back the loan.

- Support for Project Viability:

Along with offering financial support, the SWAMIH Fund also carefully evaluates projects. As a result, developers get helpful advice and assistance in guaranteeing the feasibility and success of their projects. The fund’s knowledge can aid developers in making wise choices, increasing the likelihood that a project will be profitable.

Therefore, SWAMIH FUND is a fantastic choice if your project has stopped. If your project relates to affordable housing, you can arrange it using SWAMIH FUND measurements.

Comment below if you want to learn more about Swamih Funds or its measures.

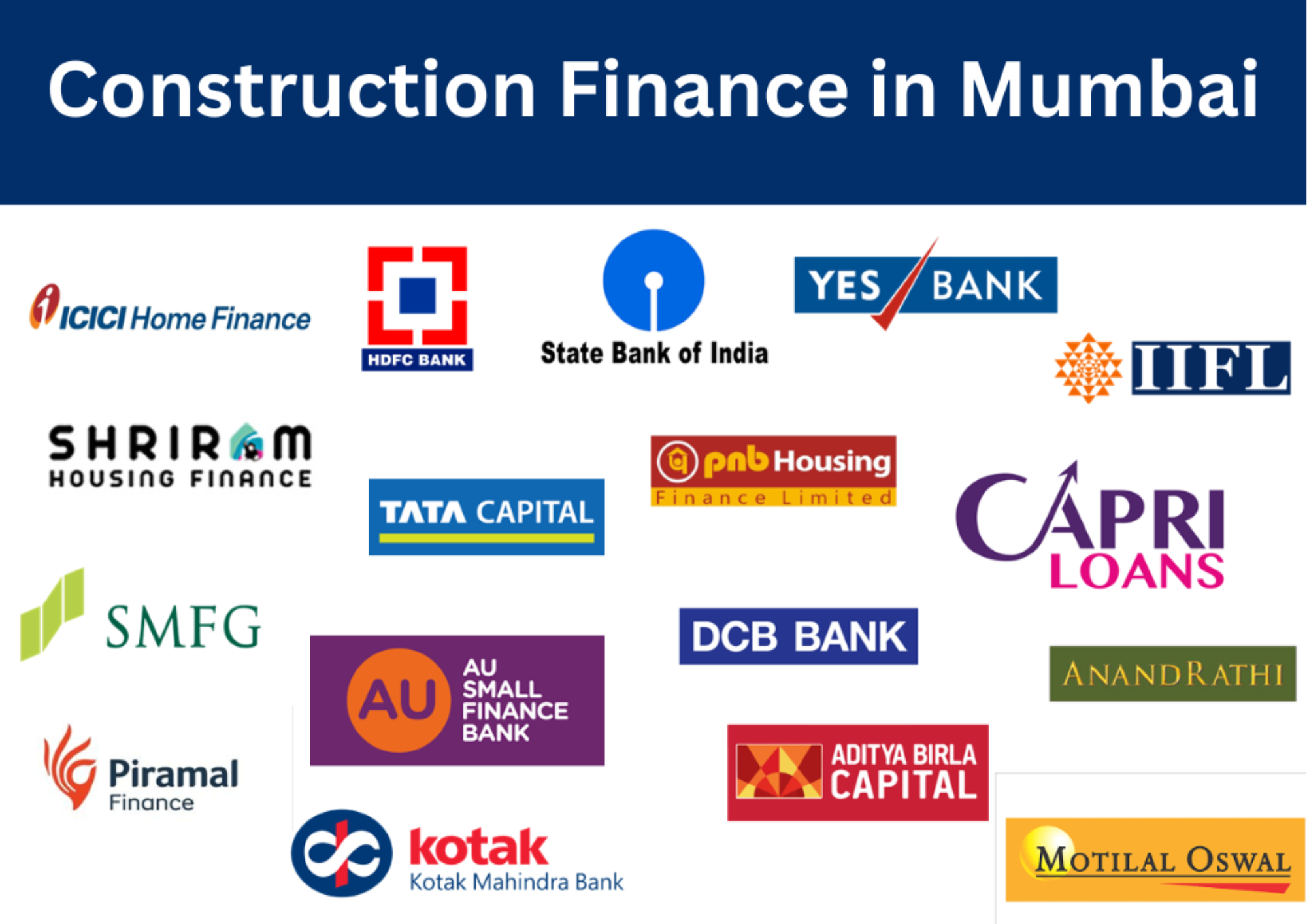

Are you a builder with ambitious construction projects in mind for the vibrant city of Mumbai? Navigating the financial aspects of construction can be a challenging endeavor, but fortunately, there are several banks and Non

How to obtain a Construction Finance in Mumbai? Understand Construction Finance Process in 12 Steps!

Construction Loan Process explained in 12 Steps Are you you considering to secure a Construction Loan for your building project, and you are unsure of how to secure the funding you'll need? We are aware

Do you need construction financing for your upcoming building project? It's critical to comprehend the obstacles that could cause your proposal to be denied before you apply. Getting loans or other types of financing to

"Payable When Able" Feature, is the Best Option for Builders Building homes and real estate projects can be a rewarding endeavor, but it often comes with financial challenges. This is where the Special Window for