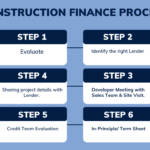

Do you need construction financing for your upcoming building project? It’s critical to comprehend the obstacles that could cause your proposal to be denied before you apply.

Getting loans or other types of financing to pay for a construction project is the process of construction finance. Lenders will need to be persuaded that the project is viable and that the borrower has the ability to repay the loan, therefore it can be a difficult and complicated procedure.

- Lack of experience. Lenders can be wary of funding a project from an inexperienced developer. They’ll want to know if you have a proven track record of finishing tasks on schedule and on budget. If you’re a novice developer, you could need to work with another developer who has more experience, or you might need to acquire a loan from a government organisation or another lender who is more ready to take risks.

- Poor financials. The ability to repay the loan and a solid financial history are also things that lenders will look for. This entails having a strong CIBIL score, a track record of paying your bills on time, and sufficient cash flow to cover the project’s expenses. If your finances are weak, you might be required to put up more collateral or apply for a loan with a higher interest rate.

- Unrealistic budget. Lenders might be afraid that you won’t be able to finish the project on time or under budget if your budget is too high. This is why it’s critical to develop a realistic budget that accounts for all project expenditures, including labour, supplies, and unanticipated charges.

- No Objection Certificate (NOC). Most lender will want an NOC from the society/ landowner, the draft will be provided by the lender itself.

The NOC will have these points:

The society does not object to the developer mortgaging the project land and unsold units to LENDER. The society will not allow the developer to transfer or exchange any units without LENDER’s consent. LENDER will have first charge on the security and can enforce it in case of default.

(To get a draft of NOC for reference, Message us)

- High Cost of Construction. One of the biggest challenges is the high cost of construction in Mumbai. Land prices are sky-high, and labour costs are also relatively high. This can make it difficult for developers to secure financing for their projects.

- Land Acquisition and Title Issues. Uncertainty regarding the land’s ownership and the existence of any liens or other encumbrances is indicated by an ambiguous title report. Lenders want to be certain that they are making a loan on a property that is trouble-free. If you are thinking about building something, you should do your research and confirm that the land is legally yours.

- Lengthy Approval Process. The lengthy approval process for construction projects in Mumbai is also a challenge. There are a number of government agencies that need to be involved in the approval process, and this can take several months or even years. This can delay the start of construction and make it more difficult for developers to secure financing.

- Lack of Collateral. The lack of collateral is also a challenge for developers in Mumbai. Most construction projects are financed with a combination of debt and equity. However, it can be difficult for developers to secure equity financing, as they often do not have the assets to back up their loans.

So, what are the solutions?

If you are considering applying for construction financing, it’s important to be aware of these challenges and to take steps to mitigate them. By doing your research and preparing a strong proposal, you can increase your chances of getting approved for the financing you need.

Here are some additional tips for avoiding rejection of your construction finance proposal:

- Work with a financial advisor who specializes in construction finance. They can help you assess your chances of approval and put together a strong proposal.

- Be prepared to provide collateral. Lenders will want to have some security in case the project goes over budget or does not complete.

- Build relationships with lenders. Get to know the lenders in your area and let them know about your project. This will make it more likely that they will consider financing your project.

- Make an accurate project feasibility report, COPMOF and Sales MIS as they will required during the initial process

By following these tips, you can increase your chances of getting your construction finance proposal approved.

Securing construction finance in Mumbai can be challenging, but it is not impossible. By understanding the challenges and by working with a financial advisor, developers can increase their chances of securing the financing they need to complete their projects.

I hope this blog post is helpful. Please let me know if you have any other questions.

-

The China Real Estate Crisis: What You Need to Know

September 11, 2023 -

Can First-Time Builders get a Construction Finance Loan?

July 14, 2023 -

RERA: The Law That Protects People Buying Homes in India

July 14, 2023