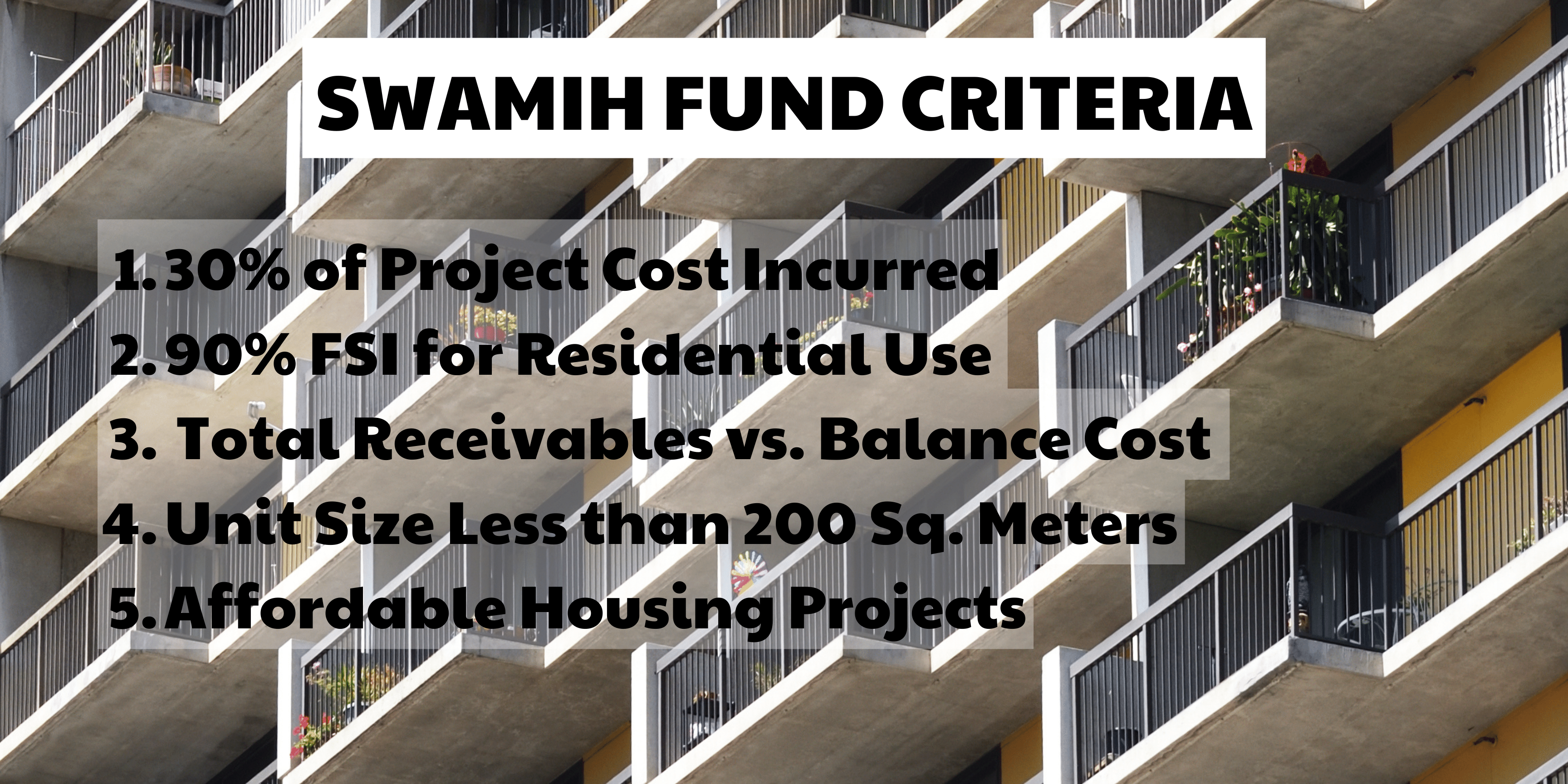

Do you know about the SWAMIH Fund? It’s a specialized fund established by the Indian government to resurrect housing projects that have come to a grinding halt. These projects, which were frequently referred to as “stalled,” “stuck,” or “stressed,” were in danger of never being completed. To ensure that these projects may ultimately resume, the government of India established this fund with an enormous 25,000 crore rupees.

There is a caveat, though: not every initiative is eligible for this support. For a project to qualify for the SWAMIH Fund, it must adhere to a number of tight guidelines or requirements. In order to comprehend how the fund functions and how it might aid in reviving them, let’s glance more closely at these criteria.

- 30% Project Cost Incurred

First things first, a project must have already spent at least 30% of its entire cost in order to be eligible for SWAMIH Fund sponsorship. This implies that before a project may receive assistance from the fund, a considerable sum of money and effort must have already been invested in it. This restriction makes sure that the fund will only support initiatives that have made a genuine attempt to get started.

- 90% FSI for Residential Use

The project’s space is the focus of the second criterion. Residential uses must use at least 90% of the available Floor Space Index (FSI). The majority of the space allotted for FSI should be used for residences. This makes sure that the fund only supports initiatives that aim to address the housing crisis.

- Total Receivables vs. Balance Cost

It’s a little challenging, but this is crucial. The amount of money a project anticipates to earn (“Total Receivables”) should exceed the amount still needed to finish the project (“Balance Cost”). Simply said, the project should generate more money from investors and buyers than it will cost to complete everything. This requirement helps ensure that the project can be successfully completed with the assistance of the SWAMIH Fund.

- Unit Size Less than 200 Sq. Meters

The size of the housing units is the fourth requirement. Each unit inside the project must be smaller than 200 square metres in order to qualify for the money. This is done to promote the building of cheap, reasonably sized homes for individuals.

- Affordable Housing

The SWAMIH Fund also gives initiatives that provide affordable housing priority. The price cap is 1 crore in some areas, such as Mumbai, where each unit must be priced at less than 2 crores. This indicates that the fund is intended to support initiatives that seek to build homes that are affordable for a large number of individuals, particularly those with middle- and lower-income levels.

The SWAMIH Fund acts as the government’s helping hand in rescuing housing developments that were in limbo. These five requirements must be met by projects in order to qualify for this assistance, guaranteeing that the fund will be used to build much-needed and affordable homes in India. So, when you hear about the SWAMIH Fund in the future, you’ll know that it’s all about giving housing projects a second chance and enhancing home accessibility for individuals all around the nation.