Construction Loan Process explained in 12 Steps

Are you you considering to secure a Construction Loan for your building project, and you are unsure of how to secure the funding you’ll need? We are aware that navigating the construction finance industry can be challenging.

However, do not worry! We’re here to simplify down the process of construction financing into 12 understandable and doable steps in our extensive blog post.

You’ll have a clear knowledge of the steps you need to take to raise the money you need for your building project by the time you finish reading this article.

Now let’s get into the specifics.

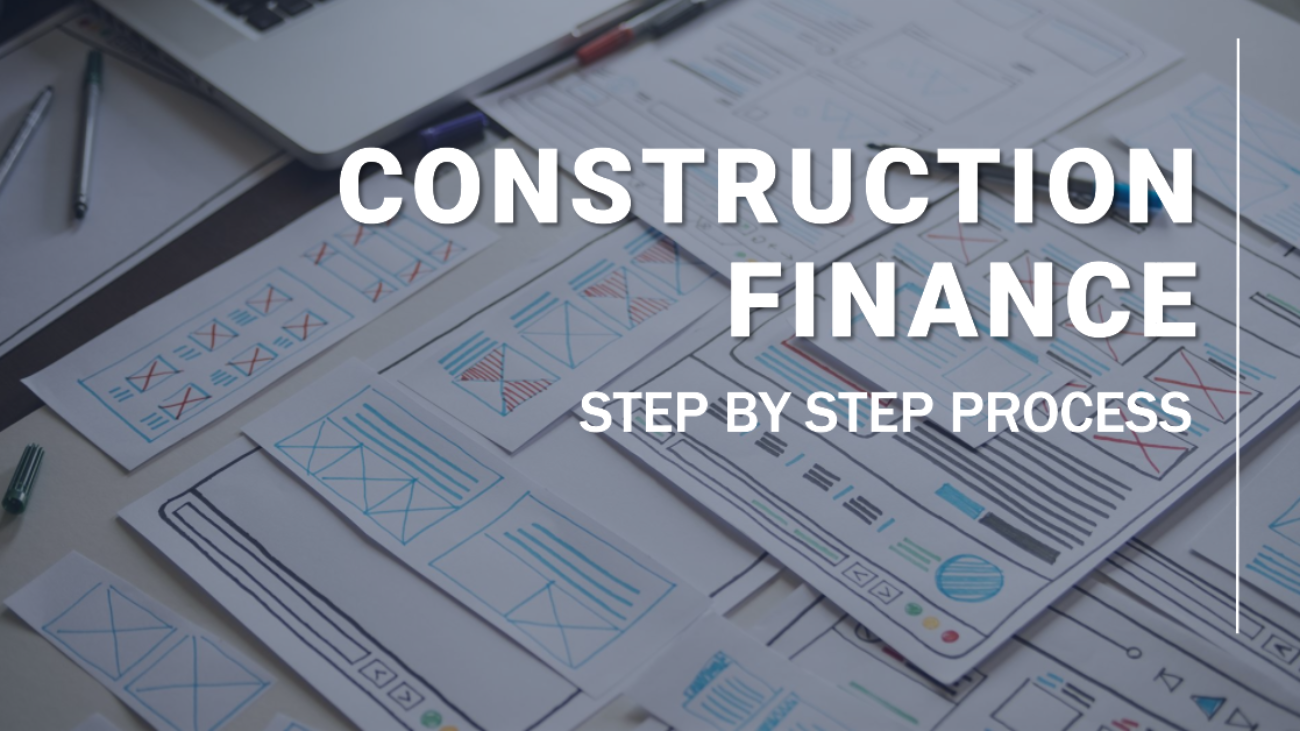

Step 1: Evaluating the Proposal

Before you dive into the financial side of things, it’s crucial to thoroughly assess your project proposal.

This involves scrutinizing various aspects of your plan against specific criteria. While this step might sound a bit technical, you can make things simpler by getting

assistance from a consulting or advisory firm. They can help you determine if

your project is viable and ready for the next steps.

Step 2: Identifying the Perfect Lenders

Each lender has its own preferences and criteria for funding projects. Some Financer might fund an early-stage project whereas others will fund post obtaining necessary approvals from government.

Your goal here is to find the lender that best aligns with your project’s requirements and goals. This process might involve some research, but it’s a crucial step in ensuring a successful financing journey.

Step 3: Sharing Project Details

Once you’ve found a potential lender match, it’s time to provide them with the details of your project. Each lender typically has their own set of formats they require you to complete. And this process could be tiring as their will be a whole bunch of details that will be requested by the lender.

If you’d like to simplify things even further, consider hiring a professional advisory that can handle this step on your behalf.

Step 4: Making a Sales Presentation and Site Visit

After your initial submission of project details, the process takes a more interactive turn. You’ll have a meeting with the lender’s Sales Team who will visit your office. This meeting serves as a platform to discuss your project in detail and to address any questions or concerns.

Following this, a site visit is scheduled. The purpose of this visit is to provide the team with an in-depth understanding of the physical site where your project will take shape, make sure you have a few labours working at the site.

Step 5: Delving into Credit Evaluation

With the Sales Team meeting successfully completed, your project is now evaluated by the lender’s Credit Team. They analyze the feasibility and risk associated with your project. This step is crucial as it helps the lender understand the potential financial risks and rewards involved. Some lenders will prefer to have a meeting with the promoter while others might not. So, If a credit meeting is scheduled then make sure all the promoters are available as it makes an impression.

Step 6: Receiving In-Principle Approval

If your project passes the Credit Team’s evaluation, you’re on the right track. The lender will issue an in-principle approval, which is essentially a preliminary green light. This document outlines key project information and highlights the terms and conditions of the loan. The in-principle will include all the details like security, escrow account, interest rate etc

Step 7: Undertaking Due Diligence

A third party legal and technical agency is appointed to carry out the due diligence process. This agency performs due diligence, a thorough process that ensures all aspects of your project are carefully examined. Make sure you have the soft copies of all the legal documents and technical documents as it will be required.

This stage can take anywhere from 10 to 20 days and is designed to minimize risks and ensure transparency.

Step 8: Committee Review

Once a satisfactory due diligence report is received, your project is presented to a committee for approval. During this phase, the committee delves into the project’s cash flows and sales milestones, discussing its financial viability in detail.

Step 9: Receiving the Final Sanction Letter

With the committee’s approval secured, the lender issues a final sanction letter to you, the developer. This is a significant step as it signifies that your project has gained substantial financial support. If you find any terms in the letter that you’d like to discuss or adjust, now is the best time to negotiate.

Step 10: Signing the Essential Documents

At this point, you’ll be faced with several important documents that need to be signed. These documents formalize the agreement between you and the lender. It’s essential to involve all project promoters as signatures will be required

Step 11: Registering the Mortgage Deed

A mortgage deed that is signed during the previous step needs to be registered with the sub-registrar. A person from the Lenders team will be accompanying you throughout the process.

This deed lists the developer units that will be used as collateral for the loan.

Step 12: Fund Disbursement and Getting Started

As the mortgage deed is officially registered, the disbursement process kicks into gear. The initial portion of funds, known as the first tranche, is typically deposited into your bank account within a few days. This marks the beginning of your construction journey!

Depending on the profitability of the project, the speed of the lender, and the size of the ticket, the entire process will take 45 days or longer.

It may seem challenging to obtain the construction loan you need for your building project, but by breaking it down into these 12 parts, it becomes easier.

You can also seek the assistance of project funding advisory or consulting organisations, who can make these procedures simpler for you because they have the necessary professional knowledge and solid relationships with lenders.

Hiring a professional agency would be a huge help if you are having trouble acquiring construction financing for your project owing to some feasibility concerns or anything else.

Every step is crucial, and things go easily when you have the right support and knowledge.

You’re all set to confidently start your construction finance experience after reading this straightforward instruction!